NAR Settlement FAQs

NAR Settlement FAQs Homeowner FAQ: Questions and Answers Related to Homeowners, Sellers, or Buyers What is the settlement about? The

The U.S. housing market is having big problems that are upsetting real estate investors and developers. Banks have stopped giving loans, which is causing people to give up on their projects and sell their properties. This is not just bad for the real estate market, but for the whole economy. This article talks about why it’s harder to get a loan, what happens when you can’t get a loan, and why smart people like Morgan Stanley are worried about all of this.

It’s interesting to note that the housing market is currently facing some challenges due to the limited availability of loans. Black Knight recently highlighted this issue, and even reputable financial institutions like Morgan Stanley are expressing concerns about its potential impact on the economy and housing market. It’s a tough situation, especially given the current economic uncertainty and possible interest rate hikes. These developments are expected to become more prevalent in the coming months.

It’s important to talk about tighter lending conditions. It means banks are being more careful about giving out loans, which could slow down the economy and hurt small businesses. This happened before during the financial crisis and it had a bad impact on normal people and small businesses. Even the software industry is being affected. This is a big concern because many businesses need money from banks to keep going.

Banks play a crucial role in our economy by providing financial aid to individuals and businesses in the form of loans. These loans allow people to buy homes, invest in their education, start businesses, and make major purchases that significantly impact economic growth. When banks stop providing new loans, it creates a ripple effect that can be felt throughout the entire economy. The impact may not be immediately evident, but over time, it can lead to decreased productivity, job losses, and slowed economic growth. The health of the economy is greatly dependent on credit availability, and without it, the economy can quickly become stagnant. Therefore, it’s important to monitor banking practices and policies to ensure that they align with the overall goal of promoting sustainable economic growth and stability.

As the global economic climate is constantly evolving and undergoing fluctuations, rules and regulations governing borrowing money have become increasingly stringent. This holds especially true for the real estate and construction sectors, which rely heavily on loans to sustain and grow their businesses. However, the current financial environment has led to difficulty in obtaining funding, causing significant problems and distress for those invested in these industries. Reports indicate growing frustration among builders and investors alike, who have been hit hard by a wave of canceled loans in recent times. Unfortunately, the situation seems set to worsen as banks display an inclination to adopt an even tighter stance on lending money. All of this combined has created a great deal of uncertainty and instability for those involved in real estate and construction.

As credit availability tightens and interest rates remain elevated, the housing market’s affordability continues to worsen. The market is currently experiencing historically high levels of unaffordability, making it increasingly difficult for individuals to enter homeownership. Experts predict that the situation will deteriorate further, with rates continuing to rise. Eventually, a significant correction is expected, either in the form of price adjustments or a significant drop in interest rates.

NAR Settlement FAQs Homeowner FAQ: Questions and Answers Related to Homeowners, Sellers, or Buyers What is the settlement about? The

Explore the world of government loans and grants for home repair in this insightful guide by Showstopper Realty, led by Andika Duncan, your go-to broker for real estate expertise.

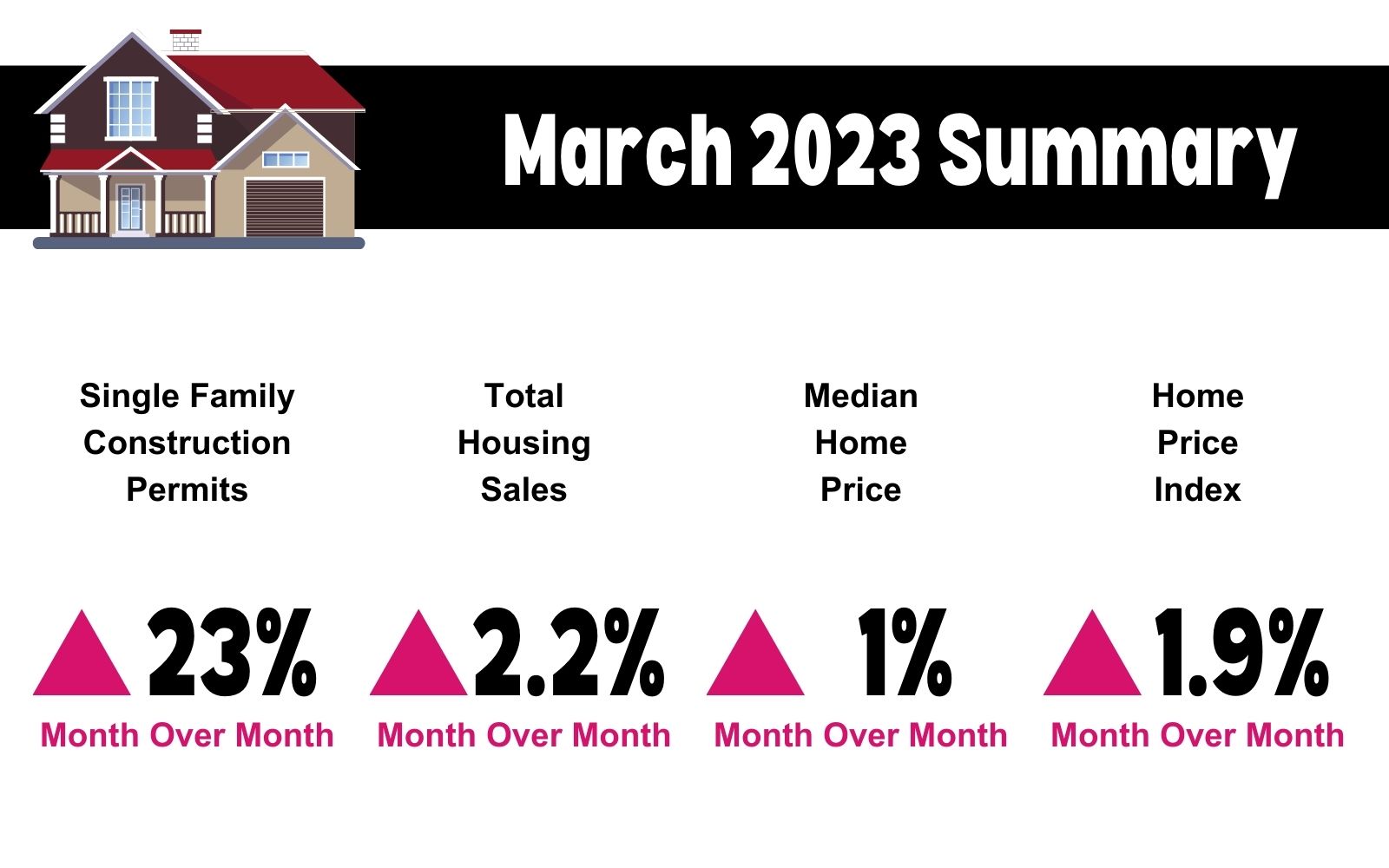

Gain insights into the construction, demand, and price trends in the Texas housing market. Explore single-family construction permits, market dynamics, and the impact of long-term rates on prices.

The real estate industry is changing because Baby Boomers prefer to stay in their own homes as they get older. This is called “aging-in-place”. It’s not just a trend, it’s a big change that affects how homes are designed, renovated, and sold. Our guide explains how fixing up homes to meet Baby Boomers’ needs can make them more valuable when selling, and how real estate agents can take advantage of this. This is a new era in real estate.

Whether you’re buying or selling, understanding property surveys, easements, and setbacks is essential. They define your property boundaries and how you can use your land. This knowledge ensures your home is more than a dwelling—it’s a wise investment for your future.

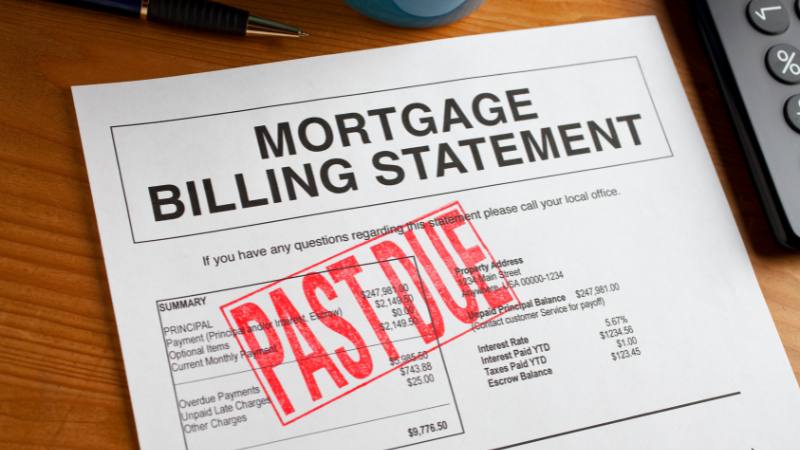

Explore Potential Mortgage Assistance Options Are you facing financial challenges that make it difficult to keep up with your mortgage